In 2024 we surveyed 840 design professionals on their architectural practices and workloads, and looked into how things had changed since our last survey in 2022. With the end of the post-covid boom and the tightening of the housing market over the past couple of years, two key trends emerged which see the shape of architectural practices changing.

Downsizing has resulted in a more fragmented workforce

There are more architects working solo than we have ever seen. The downsizing of predominately medium-sized (and many large) practices, has resulted in a bloom of senior architects and designers working as sole practitioners.

15% of NZ architects are now sole practitioners

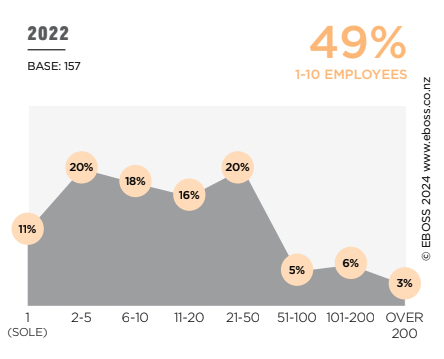

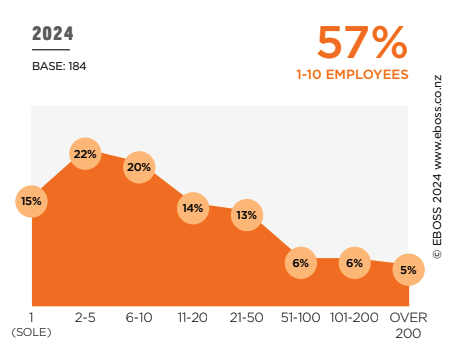

In the graphs below we can see the spread of architect employment by practice size in 2022, and again in 2024. The profile of architectural practices has changed significantly over the past two years. In 2022 we had a boom in mid-sized practices resulting from the increase in medium and high density design. Meanwhile our 2024 data shows that 15% of all architects are working for themselves, and firms employing 21-50 staff have almost halved from being the largest section to just 13% of the market.

One-third of architectural designers are now sole practitioners

Architectural Design firms have also been affected by this shift in market demand. Sole practitioners have grown from 24% to 33% of the market, and medium-sized firms have almost halved to 4%.

This shift to more sole practitioners means there is a new group of designers who are currently adapting to working without the support of a large team — and as they now work in isolation, or smaller teams, it means any opportunity to get together as an industry, through things such as conferences and events, is more important than ever.

Practices are diversifying

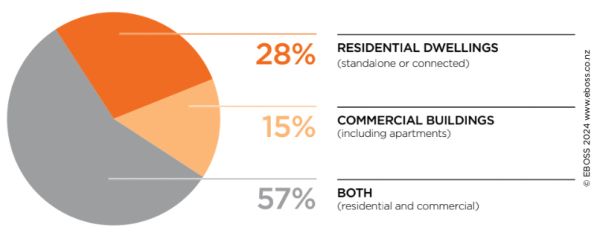

Our 2024 data tells us that 72% of architects and designers are now engaged in commercial projects.

When we look at the residential market. As a general rule, smaller firms have broadened their focus to medium density whilst maintaining a strong foothold in the detached house market. Medium-sized firms and larger firms have both reduced their dependency on residential to focus on commercial.

In the commercial market, we are seeing more projects being picked up by small firms, who are undertaking more light commercial work, while medium sized firms have grown into specific commercial categories, namely schools, healthcare and warehousing.

So what are the trends here?

1. Small firms are targeting more complex residential project work and a wider range of commercial design work

Within this, I see two key scenarios:

- a) With the tightening of the housing market, some designers are diversifying, committing to work that they have had less experience with. This raises concerns about how smaller practices can do this work profitably and how to de-risk more complex designs, which often have specific design criteria (think Ministry of Education design guidelines).

- b) We have experienced designers who have worked on commercial projects in bigger firms. They have the relationships to secure this same type of work, but now working in a much smaller team, could struggle to find the resources or systems to execute effectively.

2. Medium-sized firms are competing for larger, more specialised project work typically undertaken by larger firms

We now see more competition for larger projects, with medium sized firms targeting bigger projects as they strategically focus on key areas of the commercial market. As an example, the aged care market has become a bigger target for these medium-sized firms, allowing them to develop their project reach further. With roughly 25,000 Kiwis turning 85 each year, yet only 430 retirement villages in the country, it makes sense for a number of firms to expand their focus to this sector.

Conclusion

In 2025 we see a competitive design industry. How practices present credible proposals for both residential and commercial work is critical, however, they need to ensure they have the capability to meet clients expectations to deliver a wider portfolio of work profitability.

Next month, I'll look at the importance of cost in the current market.

Most Popular

Most Popular Popular Products

Popular Products