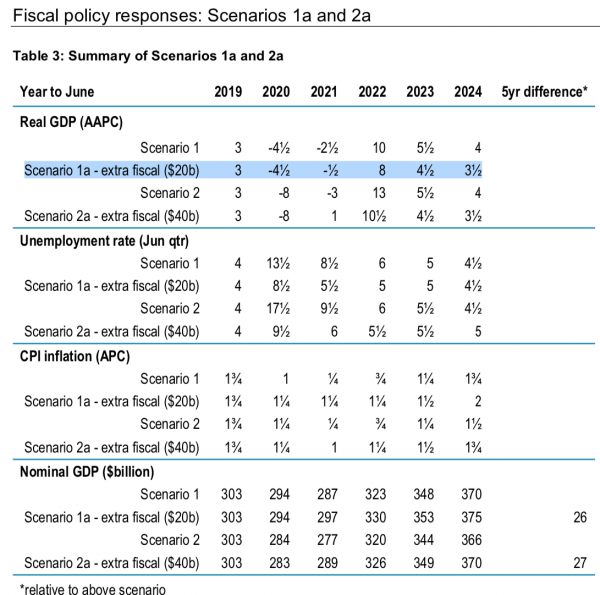

Back in mid-April Treasury put together a series of scenarios to assist with painting a picture on the impact of COVID-19. With the country entering Level 2 in the next few days, we are most closely aligned with Scenario 1a, so I thought it would be useful to add a quick snapshot.

Scenario 1a Assumptions:

- Level 4 — 1 month

- Level 3 — 1 month

- Levels 2/1 — 10 months

- Borders are closed to foreign visitors

- Government fiscal support $40B

- Budgeted loss of $16B for the year ending 31 March 2021

- See table of forecast figures for Scenario 1a below (I have highlighted the Real GDP figures).

Under this scenario, the following would happen:

- The economy would decline 4.5% in the 2020 June year, decline 0.5% in the 2021 June year, and then rise by 8% in the 2022 June year.

- The unemployment rate would peak at 8.5%, before recovering to 5.5% in 2021.

Now we are familiar with operating under Levels 3 and 4, compare your experiences with Treasury assumptions on national output. Throughout its modelling, Treasury assumed:

- Alert Level 1 reduces output by 5-10% from normal

- Alert Level 2 reduces output by 10-15% from normal

- Alert Level 3 reduces output by 25% from normal

- Alert Level 4 reduces output by 40% from normal

I think everyone would agree that 85-90% of "normal" output under Level 2 would be a great result!