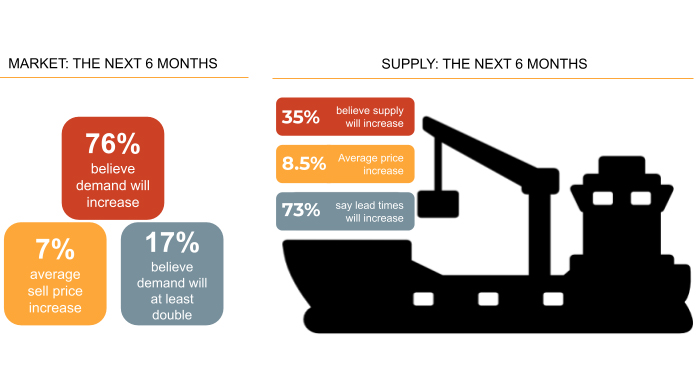

In our Supply chain survey conducted in July 2021 we asked suppliers to forecast the next six months. The picture is concerning, with demand outstripping supply and further cost increases:

- 76% expect the demand from the market to increase, yet only 35% expect supply to increase (more concerning, 28% expect demand to increase significantly, but only 5% expect supply to increase significantly)

- 73% expect lead times for products to increase (39% expect it to increase significantly)

- Costs will continue to increase, though not anticipated to be at the same rates as in the last six months. Suppliers expect costs they buy in at is anticipated to increase by 8.5% on average, while the cost their sell at is expected to increase by 7% on average

This last point is particularly concerning. We saw that over the six months to July, buy-in costs increased by 15%, yet the costs suppliers sell at only increased by 10%. This suggests that margins are being eaten by suppliers. Given that increases in buy-in costs once again outweigh increases in sell price, this provides a further hit to supplier margins.

A factor here could be the speed that suppliers can increase their prices (particularly if they are bound by long-term price agreements).

Financial viability over the next six months is a concern across the whole industry, and it looks like suppliers are no different. Yes, we are seeing a housing boom, but with the hit to margins for suppliers, combined with constrained supply, we need to ensure we’re working in a way that is sustainable for the long-term future of the industry. How suppliers manage their supply chain and contract to their customers is something that needs to be considered carefully.