It’s all about price!

When I was young in my career, I worked in sales then marketing and was fortunate to receive a lot of training; it all said that it is not about price. To be honest, I didn’t believe it, it’s always about price. Isn’t it?

Well, a few years and a few grey hairs later, I know for a fact it is absolutely not about price. Often that will be what the clients say, as it is an easy answer to give, but the reality is always more nuanced than that.

Yes, your price must be within an acceptable band, but within that there will be other aspects that will be the deciding factors. The “soft” ones are often the most important ones; do they like and trust you, have you built credibility with them, are you someone they could work with? The perceived quality of your work is another that is hard to put a metric against, experience is a concept that has a lot of latitude to it. I bet that if these are the reasons that they go against you, they won’t say it, they’d just say you were too expensive. We call these non-price attributes.

The key to sales success — I don’t mind what you do, we are all in sales — is ensuring that your perceived value exceeds your price. Doing a better job communicating your non-price attributes allows you to charge a higher price and win work over competitors at a similar price. It's about demonstrating how your product or service will solve problems, meet needs, and ultimately deliver better results, not just how much it costs.

What is a fair price?

We often hear that 10% mark-up is fair, isn’t it?

I’m not sure where this came from, but it certainly isn’t from anyone who has tried to run a small to medium business at a profit. When I talk to builders with this mark-up level, I say to them “you’ve got a job not a business”. Okay, that's a bit tongue in cheek, but I have no doubt they are not making an economic return on the time and money they have invested in their business versus the risks they are taking.

Yes, supermarkets, big commercial builders, similar high turnover businesses, can make money at these sorts of margins, but they are not typical of most NZ businesses.

This is very rough, but a typical NZ company needs a margin of somewhere around 25% to provide around a 6% net return after you deduct business operating costs (off-site overheads in construction parlance). You could go close to getting this in the bank with near zero risk! To achieve a 25% margin, you need to apply a 33% mark-up (that is a whole other post).

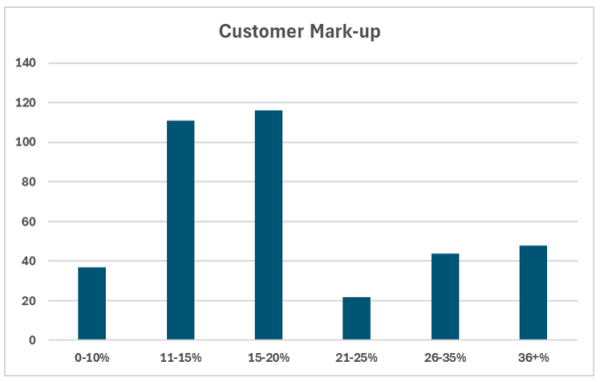

We work with over 300 builders around New Zealand helping them price their work and this is the spread of their mark-ups:

Builders with an in-house labour source typically make a margin on the labour in addition to the overall project mark-up, this would add 10 to 15% margin to their bottom line.

The other factor to consider with margin is risk. If you are taking more risk, you should expect more return. Banks pay a higher interest rate on your deposits than government bonds because, even though it is not likely they will go under, then can, so represent a higher risk.

If a project is charge-up, the risk to the builder is reduced so, a 10 to 15% mark-up (plus a labour profit) may well give a fair business return. If they are offering a fixed price, then they are taking more risk so should make a higher return, even if the project goes well, so I recommend a 15 to 25% mark-up. I.e. the higher margin isn’t some fat, but a return for risk.

Will prices come down?

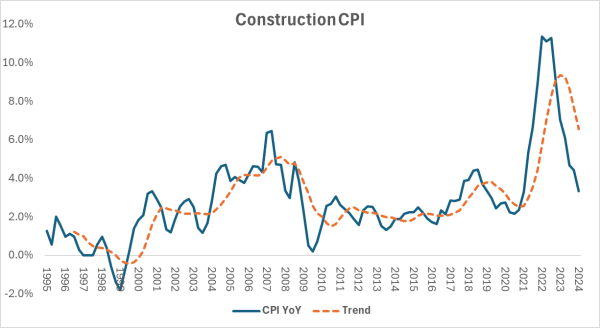

We are all aware of what happened with costs over the Covid boom, but now that the industry has slowed from that peak, will we see prices drop?

My thoughts are no, not really. We might see some short-term discounting as stockists try to reduce their holdings or businesses desperate for work drop their margins, but what I expect is the rate of increase will drop back to what was the pre-covid normal of 3-5% percent annually. The main reason I say this is so much of a building is labour. We have seen labour costs increase so unless your workers are willing to take a pay cut or suddenly become even more productive, these costs are sticky.

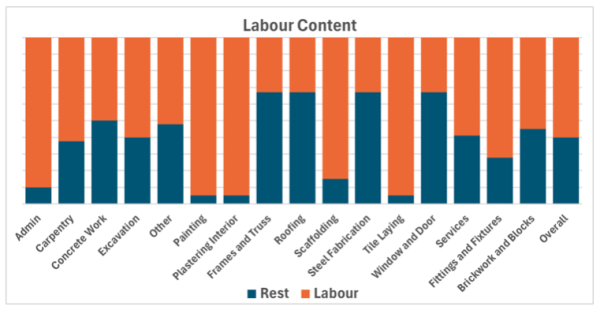

I've analysed the 417 projects ($445m value) that we have completed over the last 12 months and looked at the labour content across the trades. This shows that about 60% of the total cost of a build is labour.

For many trades we calculate the hours and materials, for the others I’ve estimated proportions. I’ve taken labour to be for the trades, not right back to the source manufacturer, as it is harder to estimate but would increase the labour portion further.

This high labour content is also why poor productivity is such a drag on the construction sector. If we can’t find ways to make our time more productive, construction will always remain relatively expensive compared to the rest of the economy.

About Nick Clements

Nick won the inaugural NZIOB 20204 Digital Technology award for his work on 3D estimating in residential construction. He is a Member of the NZIQS and is vice chair of the Auckland committee.

His business, YourQS, specialises in providing cost estimating services to residential builders, architects, and homeowners for both new build and renovation projects. They have completed over 3,200 projects since launching in 2019 working for around 300 builders nationwide.

Most Popular

Most Popular Popular Products

Popular Products