The Survey

THE SURVEY

SUPPLIERS SURVEYED ACROSS STRUCTURE, ENCLOSURE, INTERIOR, FINISH, AND EXTERNAL categories

There has been so much talk in the media about the supply and pricing situation in the construction industry, yet to date there has been very little primary data to back up the reporting.

The focus of this work is to bring real data to the table so that we as an industry can start to talk about how we need to respond in a world still impacted by Covid-19.

Note: The ratings in some of the stacked bar charts may not add to 100%. This is due to rounding.

Setting the scene

We surveyed senior managers from 240 building product and material suppliers to the construction industry in July 2021. These suppliers range from small to large companies, and across construction components: structure, enclosure, interior, finish, external, and other categories.

The categories are described as:

Structure: Aluminium, Composite Panels for Floors and Walls, Concrete, Fasteners and Connectors, Masonry, Plastics, Site Safety and Roof Access Equipment, Stainless Steel, Steel, Structural Systems, Structural Timber

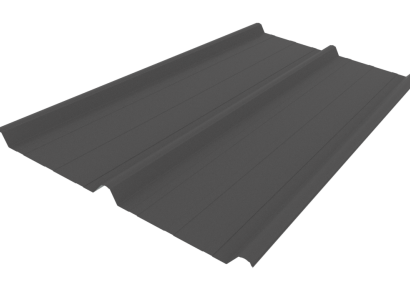

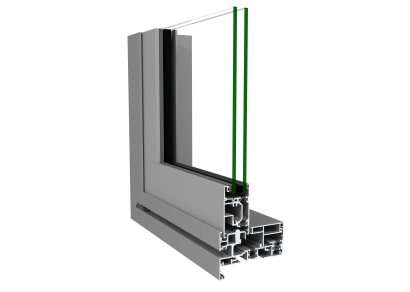

Enclosure: Awnings and Canopies, Enclosure Adhesives, Sealants and Fasteners, Enclosure Balustrades and Stairs, Exterior Decorative Items, Flashings and Expansion Joints, Glazing, Insulation, Roofifing and Decking, Tanking and Pre-Cladding, Wall Cladding, Windows, and Doors

Interior: Ceiling Systems, Floors, Furniture, Hardware, Joinery Fixtures and Appliances, Partitions and Interior Doors, Signs and Features, Wall, and Ceiling Linings

Finish: Applied Coatings, Carpeting, Flooring Ancillaries, Flooring Underlays, Overlay Flooring and Wall Panels, Painting, Decoration and Coating, Resilient Surfacing, Tiling

External: Engineering Works, External Heating, Landscaping, Roads and Paving, Stretched Fabric Systems

Other: Services, Central Vacuum Systems, Communications and Controls, Fire Safety, Heating and Cooling, Lighting and Electrical, Plumbing and Drainage, Sanitaryware, Tapware, Transport, Ventilation and Air Conditioning

SUPPLY AND PRICING ISSUES ARE AS WIDESPREAD AS THE MEDIA SUGGESTS

We asked suppliers if they were currently experiencing any issues supplying the market, and eight in ten suppliers said they were.

“NZ CONSUMERS, BUILDERS, AND SPECIFIERS NEED TO UNDERSTAND THAT SUPPLIERS ARE DOING EVERYTHING POSSIBLE, BUT THE MARKET HAS SEISMICALLY SHIFTED, AND UNLESS DEMAND DECREASES, WHAT WE SEE IN CURRENT LEAD TIMES IS LIKELY TO BE THE “NEW NORMAL” FOR THE FORESEEABLE FUTURE.””

“TO DATE WE HAVE NOT BEEN ABLE TO BUILD ANY ADDITIONAL STOCK OR COVERAGE, DUE TO LOCAL DEMAND CONTINUOUSLY EXCEEDING OUR ABILITY TO SUPPLY. TO PUT ADDITIONAL PERSPECTIVE ON HOW BAD THE SITUATION IS, WE HAVE TAKEN ON NO NEW BUSINESS NOW FOR OVER A YEAR. THE GROWTH WE HAVE IS ALL WITHIN OUR EXISTING CUSTOMER BASE.”

Larger businesses are more likely to be experiencing issues supplying the market. Among those with under $2m in revenue 61% are having issues with supply, compared to 85% of those with revenue of $50m or more.

These larger businesses are somewhat more reliant on imports (95% of those with revenue between $10m and $49m rely on imports or imported components, while 90% of $50m+ revenue businesses do so). This compares to 83% of businesses with under $2m revenue relying on imports or imported components.

The key point here is that supply issues are widespread; regardless of product category, business size or revenue level, the majority of suppliers are experiencing supply issues. Our aim here is not to add to the panic in the market but to take this data and understand what we as an industry can do to mitigate these issues, and work with suppliers to ensure we maintain productivity and supply over trying times.

Our survey has highlighted four key areas of concern that we need to address as an industry. These issues are:

- Dealing with the logistics situation

- Considering the potentially hidden price impacts and sustainability of our supply chain

- Operating in a context of a global market that is forecast to grow further

- Appropriate staffing for the supply side of the construction industry

The solution for this is not stockpiling of product or fear mongering. It needs to be a concerted effort from stakeholders across the construction industry, including suppliers, architects, specifiers, builders, clients, industry stakeholders and government.

This report will take the reader through each of these four areas of concern, paint a picture of the forecasts for supply over the next six months, and finish with what is needed as a cross-industry response to these issues.