Media Release — Auckland, 4 April 2023

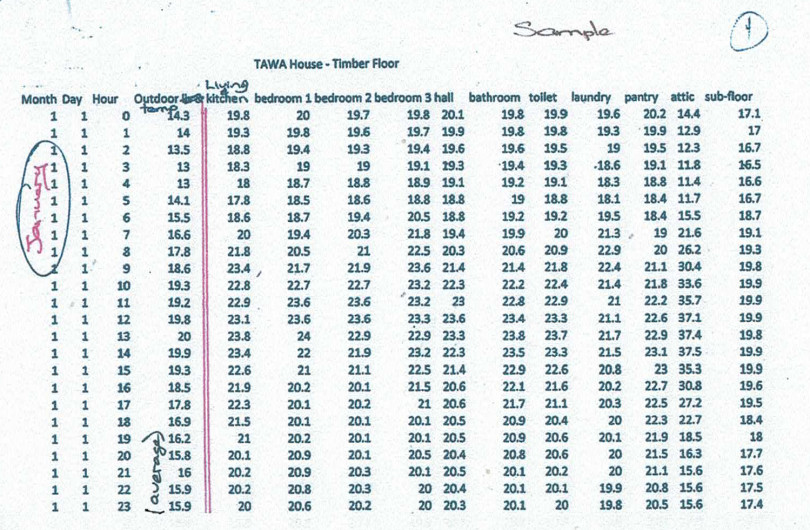

The 2023 EBOSS Construction Supply Chain Q1 Update reveals that building material prices have increased by 19% on average in the last year (a compound increase of 45% over the last two years). However, the good news for builders is that there is now a downward trajectory to some of these price increases, which halved to 6% over the past six months, and are predicted to halve again to 3% over the next six-month period. There are also reports of some building product prices decreasing — 11% of suppliers surveyed predict a decrease in their prices over the next six months.

Matthew Duder, Managing Director, EBOSS says that the Q1 2023 Update shows a welcome stabilisation or even decrease of building material prices after a tough couple of years.

“This study highlights that 8% of building product suppliers have decreased their prices over the last six months which reflects the settling down of the international supply chain which the vast majority of NZ building materials suppliers rely on either for components or finished products.”

Duder also notes that while almost a third (31%) of building materials suppliers say they are currently having issues supplying the market, this is a marked fall.

“Compared to July 2022 the number was more than double — with 64% of building material suppliers having supply chain issues. In particular, structural materials suppliers have seen major improvements; 34% said they have issues supplying the market in February 2023, compared with 78% just six months prior. This is a significant indicator that the supply chain is over the pinch points we saw in 2022 and is more resilient,” says Duder.

Duder also says that another key highlight of the Q1 2023 Update is that many building product suppliers have adopted a strategy of maintaining elevated stock levels in order to ensure they can supply the market.

“The Q1 2023 Update reports that 71% of building product suppliers had increased their stock holdings in the six months to July 2022, and 59% say they have further increased their stock holdings over the past six months. This, together with decreased international pressures, has resulted in decreased lead times — which are now almost on par with pre-covid levels.”

“Long lead times and uncertainty of supply has caused a lot of frustration over the last few years, so this is welcome news for architects, builders and building owners. Not to mention the suppliers who have had to deal with customer frustrations and loss of reputation due to the recent volatility in the supply chain,” says Duder.

The Q1 2023 Update survey, conducted following Cyclone Gabrielle and the North Island floods, shows freight pressures shifting closer to home, with 31% of suppliers saying domestic freight has become more constrained compared to a year ago. Additionally, 31% of suppliers also say they have been impacted by the recent weather events with 4% of those saying that impact has been significant.

Duder observes that the Q1 Update also reports on the cost pressures materials suppliers are under.

“Despite the price increases in building materials, what is quite startling is that only three in ten suppliers have passed on all material cost increases to date. The majority have been absorbing cost increases — with 27% planning to pass those on at a later time, and 35% not intending to pass them on at all. Overall, 98% of building materials suppliers say they are experiencing inflationary pressure, with increased operational, staff, freight and material costs reported as the biggest factors.”

“Following a challenging period for the supply chain, many suppliers are taking on additional financial strain in order to keep materials prices down,” says Duder. “This is great for builders and end customers but will need to be carefully balanced by suppliers to ensure their business’ long-term financial sustainability.”

Finally, recent forecasts for building work suggest an 18% decrease in residential building consents in 2023 compared to the ~50,000 consented in 2022. This is much more optimistic than recent reports that suggest consents are about to “fall off a cliff”. It is estimated that residential consents will fall to ~40,000 in 2023, still over the 37,000 completed dwellings estimated in 2022. Commercial construction is forecast to continue at near record levels supported by strong government building and a growing office and retail sector.

2023 EBOSS Construction Supply Chain Q1 Update Key Findings:

Product cost increases:

- The price of building products increased 19% on average over the last 12 months

- 6% was the average increase to customers from July 2022 to Jan 2023

- 1 in 12 suppliers say they have decreased sell prices over the last 6 months

- 50% of suppliers expect costs to stabilise over the next 6 months

- Suppliers predict an average 3% increase in product prices over the next 6 months

Stock holdings:

- 59% of suppliers say they have increased their stock holdings and inventory from 6 months ago

Logistics:

- 31% of suppliers reported supply constraints in February 2023, compared with 64% in July 2022.

- Suppliers in the Finish category are least confident with 41% still reporting issues supplying the market

- 65% of suppliers say they are currently experiencing freight issues, compared to 83% six months ago

- 31% of suppliers say that domestic freight has become more constrained compared to a year ago

- 31% of suppliers say they have been impacted by the recent weather events

Narrowing margins:

- 98% of suppliers say they are experiencing inflationary pressure

- 24% of suppliers say increase in the cost of staff is the biggest inflationary pressure on their business right now, while 21% say either increases in operational costs or increases in the cost of materials is the biggest inflationary pressure

- The buy-in cost of building materials grew 79% over the past two years

- 3 in 10 suppliers have passed on all cost increases to date

- 27% say they plan to pass on recent cost increases, and 35% say they plan to absorb historical cost increases

- Suppliers of structural products have seen a 13% increase in buy-in costs over the last 6 months, but have only increased prices by 3%

- 54% of suppliers in the structural products category say there are cost increases they won’t pass through to customers

The Q1 survey of 224 suppliers, conducted by EBOSS, is part of a six-monthly research series that aims to provide an update on the current and future state of the building product supply chain and help developers, architects and builders to better plan ahead.

Most Popular

Most Popular Popular Products

Popular Products