Evidence of price increases for building materials and logistic delays is everywhere. Those of you who have been watching the news, and have read through the EBOSS report on the state of the product supply chain for the construction industry will have seen that the issues we are facing are with us for a while.

Most of the projects that are being delivered at the moment are tied to an earlier fixed price contract, but what are the options for contracts that are expiring or new contracts that are being developed now?

As far as I am aware there is no standardised approach to dealing with price increases of building materials suitable for a strained supply chain. This is primarily due to wider industry still grappling with this issue, therefore the focus of this article is two-fold:

- To draw the industry's attention to what options are available currently to deal with a future expectation of further price increases and supply delays/shortages, and

- To engage with industry to develop commercially fair and equitable approaches in the near future.

Below are three options for not only quantity surveyors to consider, but also project managers, developers, architects and main contractors.

It is important to understand all options available to prepare for upcoming projects.

Referencing the Ministry of Education’s Supplementary Guidance for Valuing COVID-19 Variation Claims

On the 8th September 2021, the Ministry of Education created a process for acknowledging material price increases and delays resulting from the pandemic (as well as for main contractors and consultants to recover time and/or additional costs). These guidance documents apply to standard NZS 3910:2013 contracts and the Ministry’s Medium and Minor works variants.

Here are the templates and guidance documents (I have listed guidance for both Materials and Consultants/Contractors)

Materials:

- Supplementary Guidance – Valuing Materials Claims

- Schedule 1 - Material Notifications (regularly updated spreadsheet of cost increases for specific products)

Consultants and contractors:

- Guidelines for valuing COVID-19 project variation claims [PDF, 336KB]

- Guidelines for valuing COVID-19 consultant variation claims [PDF, 287KB]

- Major Works COVID-19 variation process map [PDF, 816KB]

- Medium and Minor Works COVID-19 variation process map [PDF, 726KB]

- Main Contractors - COVID-19 Claims proforma template [XLSX, 80KB]

- Consultants - COVID-19 Claims proforma template [XLSX, 75KB]

This follows on from last year’s MBIE guidance document following the first lockdown in 2020 on dealing with variations.

The Ministry of Education encourages all Government agencies to adopt this approach. Based on the current value of non-residential building consents, these institutional projects account for approximately 40% of the current non-residential market. So what about the other 60% (industrial and commercial projects), and the residential market?

Should we be referencing these guidelines in contracts to deal with variations for non-public projects?

One consideration is the MoE emphasis on “evidencing” costs which could inadvertently slow the recovery of increased input costs.

Referencing NZS 3910 Appendix A

Another option is using the cost fluctuations formula within NZS 3910:2013 Appendix A. This has been a rarely used option in times of a more controlled supply chain contracting on the basis of a fixed price lump sum, or a set of agreed “all-in” rates for a measure and value contract, or agreed labour rates and margin percentages applied to actual material costs.

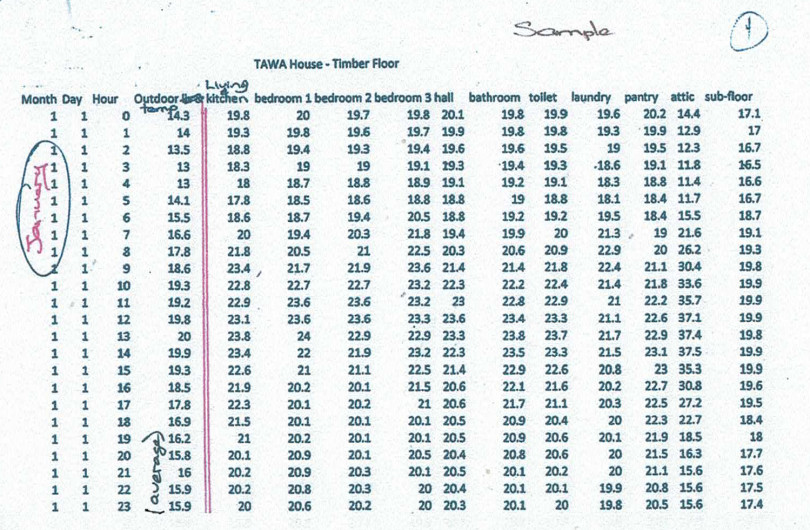

The provisions of Appendix A require a process to be established and administered properly to ensure timely and satisfactory recovery of increased input prices. These provisions also require the use of specific indices published by Statistics New Zealand in retrospect on a quarterly basis.

In practice, there may be issues with only using one formula, because of:

- The generic 40% labour / 60% materials split in the standard NZS 3910:2013 formula not reflecting the current circumstances (i.e. cost volatility across a range of materials and labour, therefore one size is unlikely to fit all), and

- The “granularity” and applicability in particular circumstances of Statistics New Zealand indices for labour and materials, noting that these are published quarterly and in retrospect which may cause cashflow issues.

In order to be more targeted, there is perhaps potential for development of the above process to establish indices for a wider range of labour and material categories and pre-code pricing documents accordingly, with input from industry.

Referencing regular industry reports

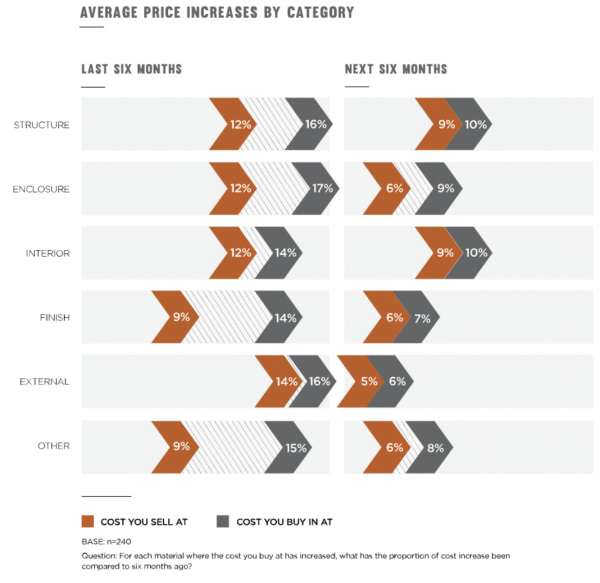

In September EBOSS published a report on recent price increases across the main product categories. They also presented a forecast of likely increases over the next six months.

Industry reports can assist with assumptions, for example Cladding (enclosure category) is forecasted on average to increase a further 6-9% over the next six months. Over time these reports can provide trend analysis to give further confidence to our ability to predict the cost of materials and their availability (or likelihood to be delayed).

Summary

For those projects that are forming contracts (and for all future projects), there is an opportunity to develop a standardised approach to mitigate the issue of ongoing cost increases and supply shortages.

Thinking about an approach, here is a list of initial considerations for claims associated with cost fluctuations. The claimed cost:

- Needs to be outside of what was already included and could have been reasonably foreseen at the time of the most up-to-date tender price or Contract Price (and considering any exclusions),

- Needs to be reasonable (and not “aspirational”) from the supply chain,

- Needs to be validated as being realistic at the time of the claim, and

- Needs to include a reasonable level of mitigation to reduce the impact on cost (and time). This may include a process to source alternative products to those documented within the design.

Using the above initial considerations (and/or other similar considerations) mitigates the issue of cost increases as far as is reasonably practicable whilst maintaining a commercially fair and equitable position under the Contract, however, this issue is far from eliminated, and price increases will almost certainly continue to occur.

In any event, the process must be efficient and uncomplicated to avoid delays and errors in the entitled recovery of increased input prices by the supply chain.

Next steps

Please feel free to leave a comment in the comments box below — we welcome wide input from the industry. This is particularly in relation to comments on the current options available and the initial considerations above as they relate to cost fluctuations to ensure that any outcomes are commercially fair and equitable to all.

Finally, I note that NZ Standards have recognised that NZS 3910 had not kept pace with recent legislation changes and are undergoing a review of NZS 3910 and have indicated they will be seeking feedback and recommendations from industry. This review was already occurring prior to the emergence of the current supply issue, however, it would presumably be very good timing for the review committee to consider industry feedback on this.

Many thanks to Rawlinson’s for their input into this article.

Most Popular

Most Popular Popular Products

Popular Products