Considering we are at record levels of residential construction with 48,899 new builds consented in the year to December 2021, I wondered what impact this was having on the renovation market, which anecdotally has been strong, particularly based on three large influences:

- Well documented increases in house prices nationally

- Excess of vacation funds with no overseas travel

- Access to cheap finance (until recently)

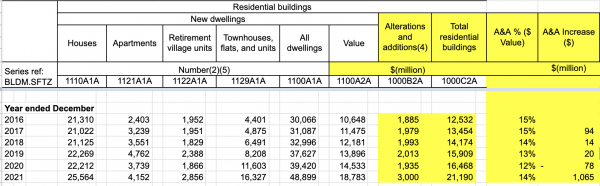

Firstly, I asked BRANZ. Their data showed an analysis of "real values of consents" which excludes the price increases from the last 10 years, to give us an even footing to compare annual performance. Their conclusion was that the value of alterations and additions (A&A) work is roughly the same as 2016 and 2017 figures, at an estimate of $2 Billion per year of consented renovation projects, so has not reached unprecedented levels.

However, they did highlight that the performance was impressive considering how high A&A levels are with record dwelling activity. Another consideration they pointed out is the potential impact of the exemptions from August 2020, with additional buildings <10m² or <30m² with no plumbing, no longer requiring a building consent.

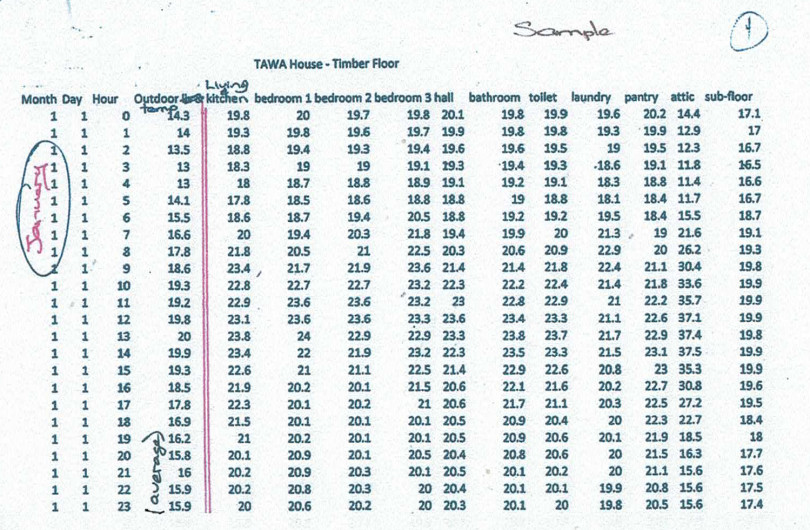

Feedback from our supply partners overwhelmingly supports the notion of a rapidly growing renovation market over the last two years. So here is my analysis below, based on the Stats NZ December 21 figures (see renovation figures highlighted):

We can see that annual consent value for renovations has grown from ~$1.9B in 2016 to ~$2.4B in 2021. 2020 saw a decrease of $78M, which you can assume was due to our initial lockdowns, with a strong rebound in 2021 of $472M, as we developed a better understanding of the property market.

However, over the five years, as a percentage of the total residential consent value, renovations have decreased from 15% to 11% of the total value of consented residential construction.

If we consider the exemptions post August 2020 having a small impact (~10%), and potentially BC applications for renovations having a larger under-estimation of cost than new builds (more unknowns and less fixed price contracts compared to new builds), it would not be out of the question for the actual figure to be higher. A total 20% increase would bring consented renovations closer to $3B or 14% of consented residential construction. Let me know whether you think this is closer to the truth.

Further analysis could look at Council Code Completions to determine the number of annually completed renovations which may well have a higher completion percentage than new builds — something I will share with you once I have some data. Or if you can spare me the work, and have your own insights into this, please share them with me in the comments section below.

Most Popular

Most Popular Popular Products

Popular Products