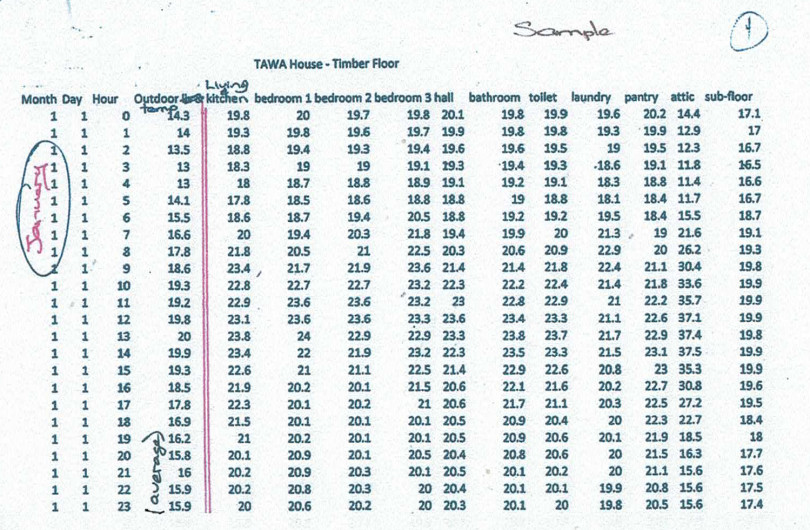

Two recent building consents forecasts do make for mixed reading.

The strength of commercial consents is expected to continue through 2024. Unsurprisingly, the recent upsurge in warehousing and factory buildings to bolster our domestic storage and production is weakening, but a strong pipeline of infrastructure, health and education spending by central government underpins a solid investment in non-residential buildings.

Forecasts for residential new builds tell a different story, however.

In the last few weeks two industry bodies have revised their forecasts to 37,000 residential new builds for 2023. For one forecast this was a revision of 10% within a 3-month timeframe, which in itself speaks to how quickly this correction from record highs is happening. With over 9,000 new residential dwellings consented in the first 3 months, that leaves ~7,000 per quarter for the rest of the year.

Forecasts for 2024 are predicting further easing, with residential new builds losing another 16% to 31,000 consents. To keep this in context, for those who did not experience the GFC, we are still miles away from the 2012 low of 13,662 residential new builds for the year.

We must acknowledge that for many the next 6 months will be tough, so beyond the welcome news that commercial building consents value will hold at about $10B a year, where are the reasons to be upbeat?

We think there are 5 positives to focus upon:

- The recent OCR hike to 5.5% is likely to be the last increase in this market — so we can catch our breath… and with 50% of all mortgages set to be refinanced over next 6 months, a more predictable upper level will help settle the nerves.

- Despite the cash rate close to trebling in 12 months, the FHB (First Home Buyer) market remains encouragingly buoyant with lending to this segment increasing as a proportion of overall lending (now 24% of total).

- And 25% of new builds are bought by this FHB segment, which will support the largest and fastest growing segment of the market: townhouses and apartments.

- Positive net migration trends have already introduced a further 65,400 people into the market in the last 12 months. Along with the natural population growth of 18,600 new Kiwis, this results in an estimated 36,000 new dwellings (23,000 for new migrants and 13,000 for new Kiwis).

- The outlook for Renovations & Alterations looks strong as existing homeowners will likely seek to improve their houses in lieu of moving.

And for further perspective… the predicted 2024 residential consents at 31,000 is in fact at 2017/2018 levels — so perhaps we can conclude the recent highs of the ‘Covid years’ were merely an exceptional blip and we are now adjusting to the normality of the longer term trend.

Released next week is the latest edition of The Pulse (Issue#3) where we detail further market driving numbers and factors — all designed to initiate strategic discussion and enable more informed decision making as you navigate the months ahead.

To receive a priority copy, send an email to [email protected]

Most Popular

Most Popular Popular Products

Popular Products